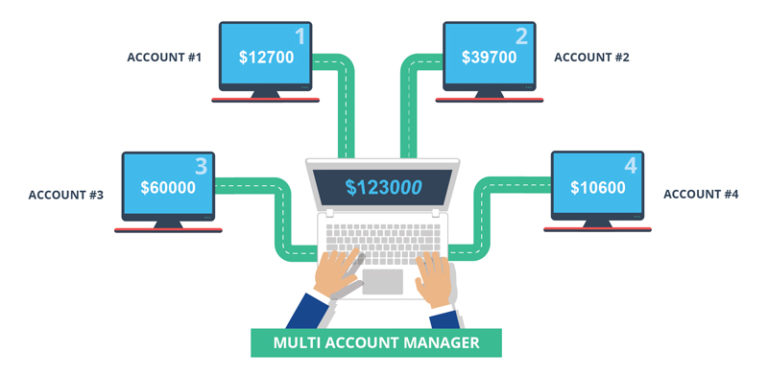

Multi-Account Manager (MAM) Solution

Get rewarded with our money management solution for your business

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

What is a MAM account?

ATG MAM account allows an authorised fund manager to trade on behalf of their clients. The managers are then rewarded with commissions, performance fees, and management fees contingent to their client trading results and activities.

With this arrangement, clients may profit from having their accounts managed by ATG-authorised traders

How does a MAM account work?

Unlike the PAMM account, MAM account allows for prorated profit-sharing and MAM accounts tend to be sophisticated in fund allocation for various trading strategies. MAM account is ideal for seasoned traders who prefer to be actively involved in every investment decision and fund allocation for various trading strategies.

ATG offers the best infrastructure for money managers who understand the significance of a partnership with an established award-winning broker.

The popularity of the ATG MAM platform is a testament to its stellar reputation among money managers globally.

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

Reasons to start using PAMM account

The minimum trade volume

is used to ensure optimal trade allocation

Equity is allocated

via a standardised allocation

method

Master accounts have access to STP

and instant allocation

Level Accounting

Master accounts have partial order close, pending order functionality,

full SL and TP

Every trading style is allowed, including scalping and hedging

Customisable rewards, fees and commissions

EA trading is allowed for

MAM Masters

Real-time order management, including instant addition and removal of funds